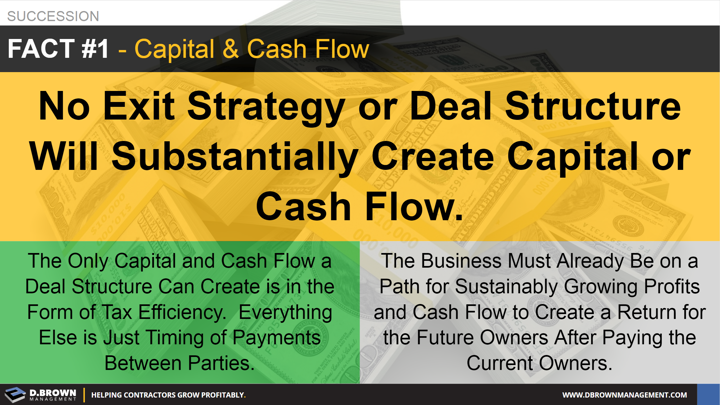

It is only the business performance that ensures all major stakeholder groups are compensated properly for their time and capital put at risk.

- If the deal will only pencil out returns for both parties due to some intricate tax strategy, then the deal probably shouldn’t be done. With that said, invest wisely in your advisors to make the transaction as tax efficient as possible.

- It is only in the rare cases of truly strategic sales that the business substantially increases in its ability to make profits and generate free cash flow after the transaction is completed.

- Outside of a strategic sale, if the business will substantially increase the trajectory of profit growth and free cash flow, that means that less of the value was created by the current owner. This will result in a lower valuation for the current owner in the transaction to make the simple capital formula work.

The saddest thing we see during ownership transitions is when the ownership groups and management start to focus more on intricate hypothetical deal models rather than aligning on increasing the true underlying value of the business.