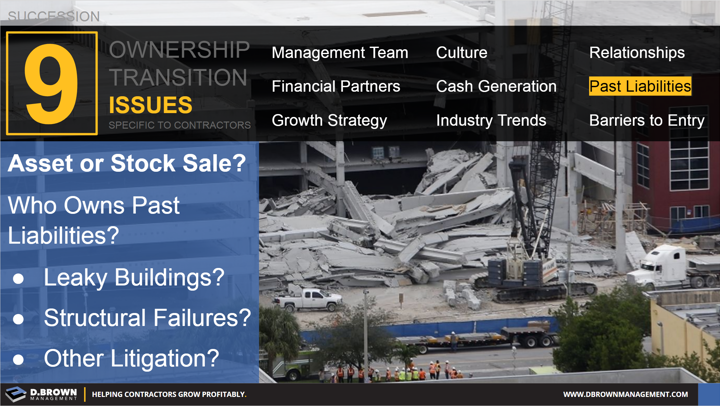

Not only is construction a cash-intensive business, it is also a risky one.

- Most of those risks show up pretty quickly but some of those risks can lay hidden for months or years.

- Some of those risks will be covered by insurance but others can cost the business significantly.

In an asset sale, a new construction business is formed and buys the physical assets of the old business, along with an additional amount of “goodwill” for the difference between the valuation paid versus the actual asset value.

There are some tax advantages for the buyer in this situation due to being able to depreciate the goodwill on their balance sheet. Additionally, they only have to purchase the assets that are truly valuable to the business operations while also limiting their liabilities for anything in the past.

The downsides include a typically worse tax situation for the seller while they maintain responsibility for past liabilities and may have to dispose of any assets not purchased. This is reflected in the valuation.

In a stock sale, 100% of the business entity is transferred to the new owners.

The Corporate Finance Institute has a good article summarizing both.

These are just decisions to make as part of working out a deal structure. There is no single right way for all situations, so it is good to have advisors who will help you look at all sides.