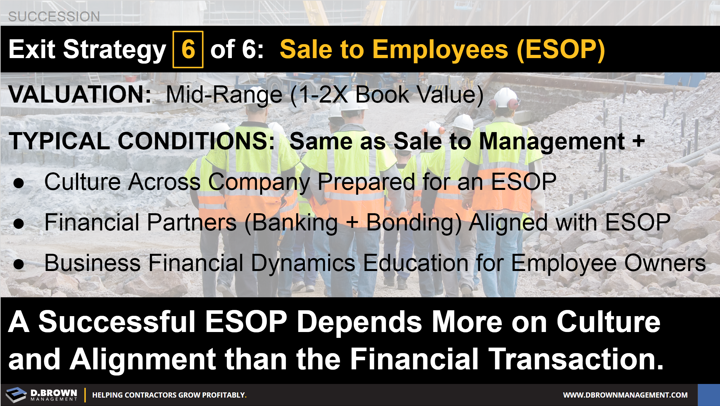

This is a more complex and costly structure to set up and maintain but also comes with some tax advantages. And while these costs and savings are easy to model, they should not be your deciding factor in whether a ESOP should be all or part of your exit strategy.

For starters, this exit strategy should be weighed against a sale to management because all the same prerequisites have to be met, including having strong leadership, an aligned management team, and a business that is continually generating excess cash flow for funding of the deal.

The big initial questions to really dig into:

- Will broader employee ownership make the business operate better than having a smaller group of managing owners who carry more of the risk but also have more to gain?

- Is the culture truly prepared for an ESOP? In a leveraged ESOP, often other contributions to retirement programs and bonuses are cut back which can demoralize a team without the proper education.

- Will your bank and surety be onboard with an ESOP?

Resources:

- ESOP Overview Article

- Top 100 ESOPs - See any contractors you recognize?