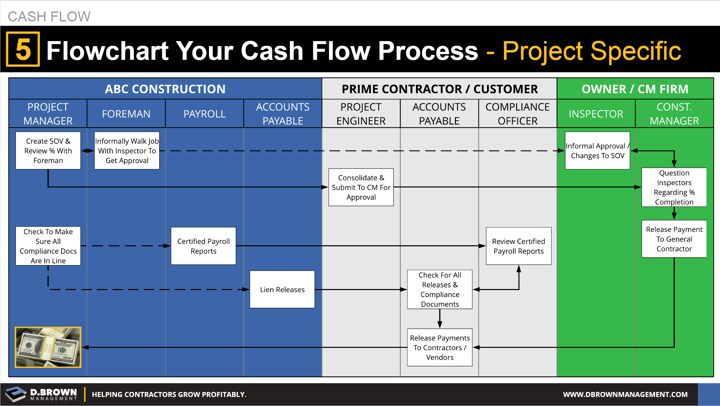

You can only see the full value-stream of cash flow, the waste, the people and the opportunities for improvement by mapping out every step.

- Look beyond your functional area inside the company. Who is EVERYONE in your company that is involved in the cash flow process?

- Look upstream to your customer. Who do you send your progress billing to? When? What happens to it from there?

- Does your customer getting paid (Pay When Paid) impact your payment? If so map out the people and processes at your customer’s customer.

- Look downstream if applicable to your vendors and subcontractors. What do you need from them to ensure optimum cash flow? This might include their progress billings, change orders, lien releases and compliance documents?

- Who else is involved that can influence the process? This might be a outside inspector, auditor or compliance officer.

- What happens in the process if there is a problem along the way? Map out those details and decision trees as well.

Now start looking for opportunities to improve the flow through this map. Even within your company ask yourself whether the flow is making optimal use of everyone’s time.

Imagine trying to troubleshoot something in a building without having a set of plans. That’s what trying to improve cash flow is like without a flowchart like this.

We are revamping our publicly available cash flow workshop that includes these 18 tactics that contractors can use to accelerate cash flow. Stay informed of updates on release.